Designing Advanced Investment Plans with Confidence

Welcome to a clear, human approach to building wealth that lasts. Chosen theme: Advanced Investment Plans. We blend disciplined strategy with lived experience so you can act decisively, sleep well, and stay invested through every market season.

Define a hierarchy of goals

Start by ranking essentials, aspirational goals, and legacy aims. One reader separated home security, early sabbatical, and charitable endowment, then aligned risk by goal. Try it, and tell us which priorities surprised you most.

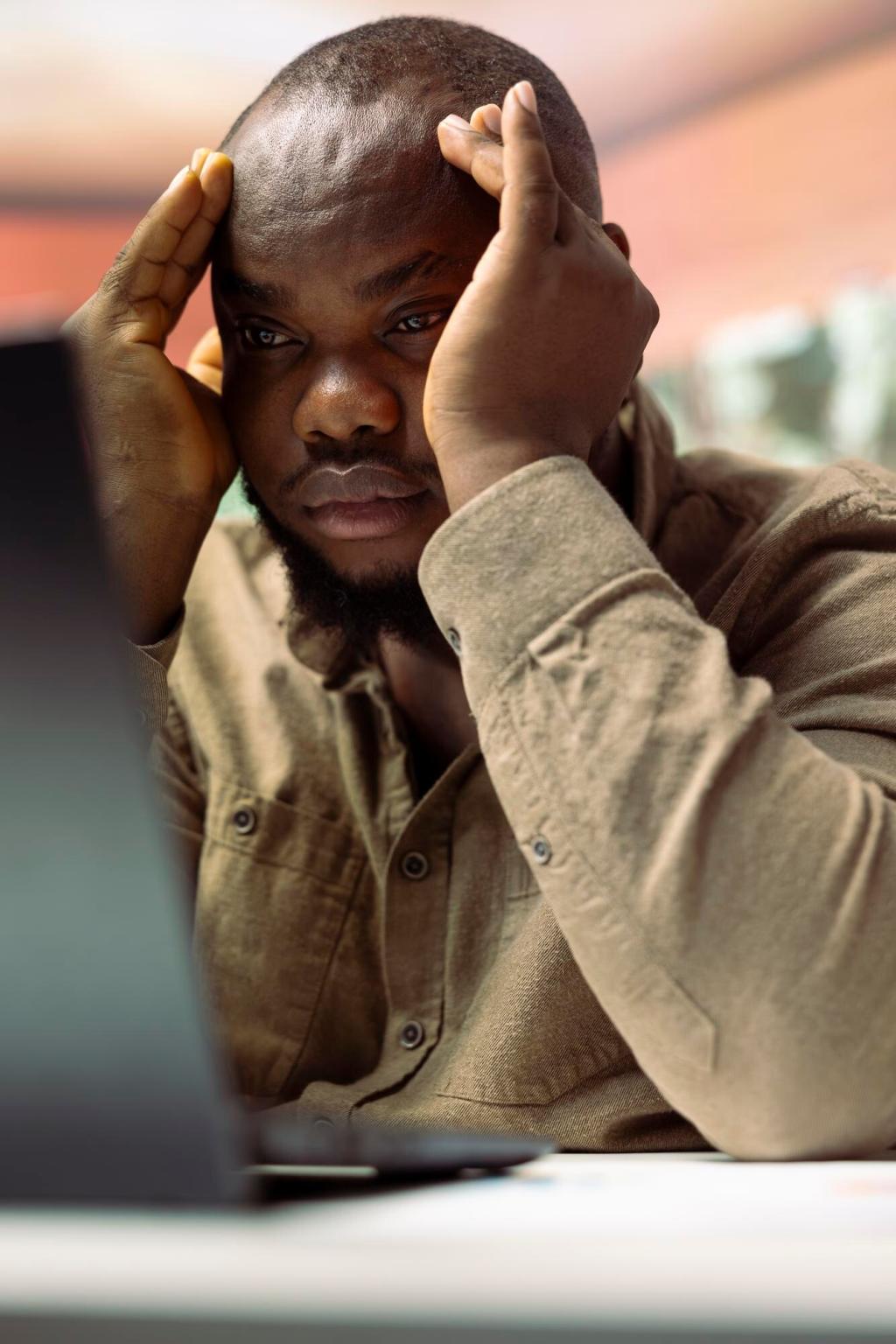

Set a risk budget you can actually live with

Declare your maximum tolerable drawdown, volatility, and liquidity needs before allocating. A founder here capped a 15% drawdown and avoided panic during a sharp selloff. What drawdown would keep you invested when headlines get loud?

Write an Investment Policy Statement that guides you

Put allocation targets, ranges, rebalancing rules, and decision criteria in writing. A two-page Investment Policy Statement can defuse emotional whiplash. Comment “IPS” if you want our checklist and we’ll share a practical template.

Allocation That Works Harder Than 60/40

Core–satellite with factor tilts

Anchor with broad, low-cost exposures, then add satellites in quality, value, momentum, or small-cap factors. A reader’s core stayed steady while a modest value tilt cushioned a growth slump. Share your favorite satellite idea and why.

Integrate private markets thoughtfully

Private equity, private credit, and real assets can smooth volatility but demand patience and due diligence. Match lockups to long-term goals, not near-term needs. If you’ve navigated capital calls, drop your best planning tip below.

Global diversification and currency decisions

Invest globally to reduce single-country risks, then choose when to hedge currencies. One investor hedged developed-markets bonds but kept equity currency exposure for diversification. How do you balance simplicity with precision in your own plan?

Risk, Drawdowns, and Real Stress Tests

Drawdown control beats prediction

Set guardrails like maximum position sizes, stop-buys for rebalancing, and cash buffers for spending. You can’t predict shocks, but you can cap damage. What’s your number-one rule when markets drop and nerves start buzzing?

Sequence risk and spending buckets

Retirees face timing risk if bad returns hit early. A reader kept two years of expenses in cash and three in short bonds, letting equities recover. Which bucket approach would make you comfortable staying invested?

Hedges and ballast when it matters

Long-duration Treasuries, managed futures, or tail hedges can cushion meltdowns, but costs and timing matter. A small, rules-based sleeve helped one subscriber stay calm during a spike in volatility. Tell us what’s in your safety toolkit.

Tax Efficiency as a Return Engine

Asset location and smart wrappers

Place tax-inefficient assets—like bond funds and REITs—in tax-deferred accounts, while keeping broad equity index funds in taxable for lower ongoing taxes. What’s your most effective asset-location win from the past year?

Harvest losses without tripping rules

Use tax-loss harvesting to offset gains, but watch wash-sale rules by choosing similar, not substantially identical, replacements. One reader rotated factor funds to keep exposure. Share your go-to pairings that keep strategy intact.

Give appreciated assets strategically

Donate long-term appreciated shares or fund a donor-advised account to reduce capital gains and support causes you love. Have you used gifting to rebalance your portfolio and your heart? Tell us how it felt and what you learned.

Build ladders and barbells intentionally

Combine a Treasury ladder for near-term needs with a barbell of cash and risk assets for long-term growth. A CFO reader said this ended their ‘emergency sell’ moments. Would this mix calm your own decision-making?

Rebalance as a habit, not a hunch

Use bands or calendar rules to rebalance into weakness and out of froth. One subscriber set 5% bands and felt relieved during rallies and dips. What rebalancing rule would you actually follow in real time?

Behavior, Governance, and Review Cadence

Before big moves, imagine what went wrong a year from now. One reader’s pre-mortem stopped an overleveraged bet. Journal your rationale, risks, and exit plan. What would your future self thank you for avoiding?

Behavior, Governance, and Review Cadence

Automate contributions, rebalancing, and bill pay, then set manual review gates for exceptions. Systems handle routine, humans handle nuance. Where could one small automation free your mind to focus on strategic choices that matter?