Build a Future You’ll Be Proud Of

Today’s theme: Long-Term Savings Plans. Let’s turn patient choices into powerful outcomes—blending clear tactics, real stories, and friendly nudges so you can start strong and stay motivated for years.

Why Long-Term Savings Plans Matter

The Quiet Power of Compounding

Compounding is interest earning interest, a snowball that grows as it rolls. Even modest monthly contributions accumulate meaningfully over decades, especially when reinvested. Start early, stay consistent, and let time become your most reliable investing partner.

Beating Inflation Over Time

Inflation gradually erodes purchasing power, which is why long-term savings plans need growth assets. A diversified portfolio aligned to your horizon helps your money outpace rising prices and preserves the lifestyle you’re working so hard to secure.

A Story: Maya’s Ten-Year Turnaround

Maya began with $150 per month, increasing contributions by just three percent each year. Ten years later, the habit mattered more than any market headline. Her balance reflected patience, not perfection—and she now mentors others to start earlier than she did.

If a 401(k) or 403(b) offers a match, capture it first—it’s instant return. Use target-date or low-cost index funds for simplicity. Increase contributions with each raise to build momentum without feeling the pinch in your monthly budget.

Traditional IRAs may reduce current taxes, while Roth IRAs offer tax-free growth if rules are met. Consider your current and expected future tax brackets. Diversifying tax treatment across accounts can create flexibility when you finally draw income.

After filling tax-advantaged spaces, use a taxable account to invest for mid-range goals. Favor broad-market index funds for tax efficiency. Keep records of cost basis and harvest losses thoughtfully, staying focused on your long-term savings plan objectives.

Goals, Milestones, and Automation

Purpose-Driven Targets

Tie your long-term savings plans to meaningful outcomes—financial independence, a sabbatical, or security for family. Quantify a monthly target, choose a timeline, and check progress quarterly. When the goal matters, sticking with the plan becomes dramatically easier.

Automate and Increment

Set automatic transfers on payday to ensure saving happens before spending. Schedule annual contribution increases, even small ones. Over time, these quiet adjustments create impressive growth with minimal friction and far less temptation to skip or delay.

Milestones and Mini-Celebrations

Break big horizons into milestones—first $5,000, $25,000, then $100,000. Celebrate progress in small, meaningful ways that don’t derail your budget. Share your milestone with a friend or community to stay energized and accountable to your long-term savings plans.

Managing Risk Over Decades

01

Time Horizon and Asset Mix

Long horizons typically favor higher equity exposure for growth, while shorter horizons lean toward bonds and cash. Align allocations to when you’ll need the money, and adjust gradually as your target date approaches to reduce unwelcome volatility.

02

Diversification That Actually Helps

Spread risk across asset classes, sectors, and geographies to smooth returns. A broad mix of stocks, bonds, and possibly real assets reduces dependence on any single driver. Diversification is the seatbelt of your long-term savings plans—quiet but essential.

03

Rebalancing Without Drama

Set rules to rebalance annually or at defined thresholds. This trims winners and adds to laggards, keeping risk steady. Follow your written plan, not the news cycle, and you’ll avoid emotional decisions that can sabotage decades of patient work.

Default Your Way to Success

Use automatic enrollment, autopilot contributions, and pre-committed increases. Keep your emergency fund separate to avoid raiding investments. Simple defaults turn smart decisions into your daily baseline so progress continues even on your busiest weeks.

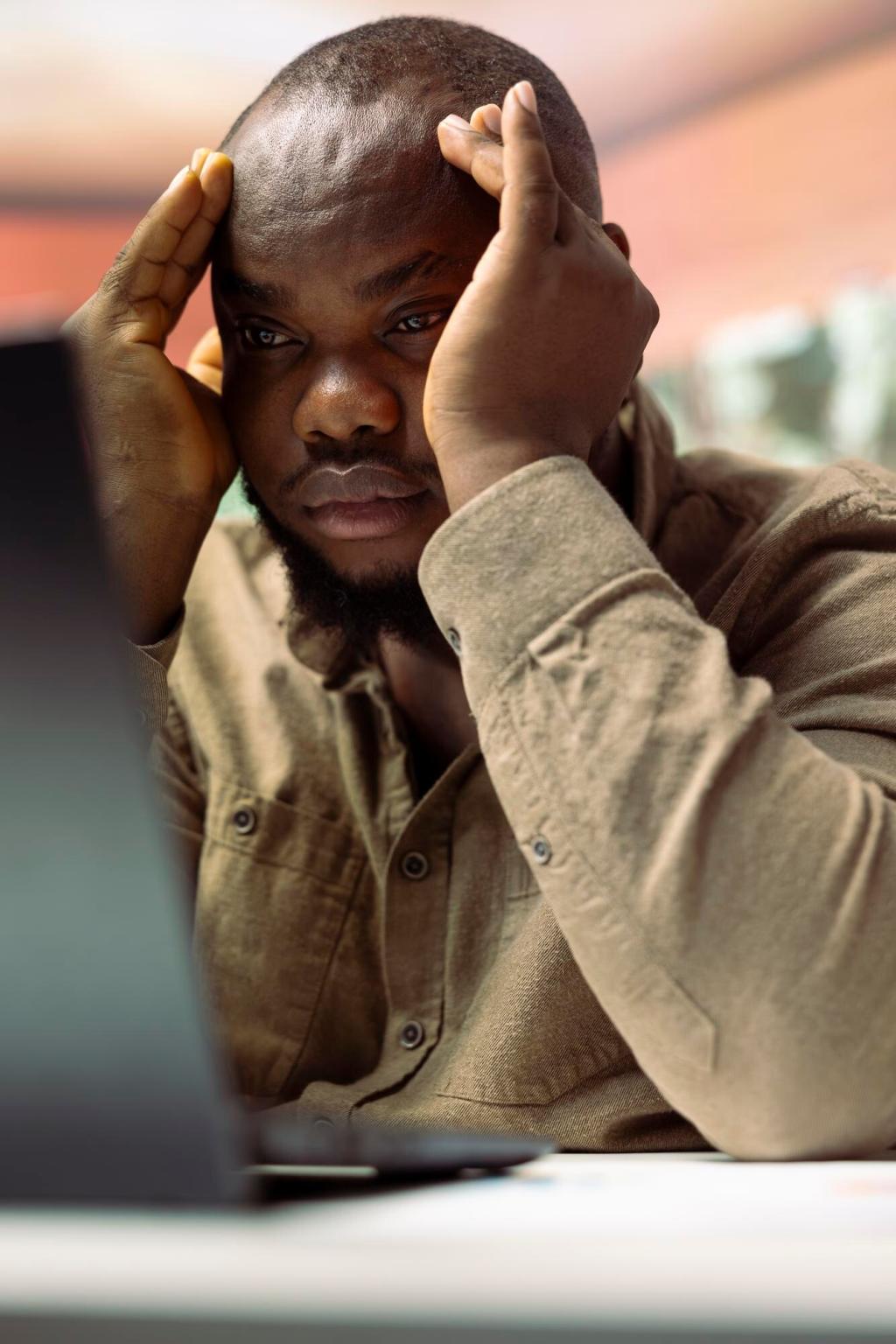

Stay Calm Through Volatility

Market drops are normal and temporary; your horizon is long. Review your plan instead of the headlines. If you need reassurance, reread your investment policy statement and talk with a trusted partner before making reactive changes you might regret.

Community, Accountability, and Subscription

Tell a friend your savings goal, post a monthly progress snapshot, and invite someone to check in quarterly. Join our newsletter for steady, encouraging nudges and data-backed tips that keep your long-term savings plans moving in the right direction.

Protect the Plan Before You Grow It

Keep three to six months of essential expenses in a high-yield savings account. This buffer prevents you from selling investments at the worst times and safeguards the steady contributions your long-term strategy depends on.

Protect the Plan Before You Grow It

Health, disability, and term life insurance protect both savings and loved ones. Adequate coverage ensures a crisis doesn’t undo years of effort. Review policies as your responsibilities change to keep your long-term savings plans resilient and intact.